Home Insurance vs. Home Warranty: Essential Protection Strategies for 2025

Homeownership involves ongoing responsibilities, and selecting the appropriate safeguards ranks among the most critical choices. Home insurance and home warranties address distinct risks, yet many individuals overlook these differences until an issue arises. This guide clarifies their roles, enabling informed decisions that secure both property and finances in 2025.

Core Differences Between Home Insurance and Home Warranties

Home insurance serves as a financial safety net against unforeseen perils that threaten the home's structure and contents. Policies typically encompass damage from events like fires, windstorms, or burglary, alongside coverage for personal items and legal liability if visitors sustain injuries. Lenders often require this protection to mitigate risks associated with financed properties.

In contrast, a home warranty functions as a maintenance agreement focused on operational components. It addresses failures in systems such as heating, ventilation, plumbing, and electrical setups, as well as appliances including refrigerators, dishwashers, and dryers. Coverage applies specifically to breakdowns from regular use, excluding structural integrity or external damages.

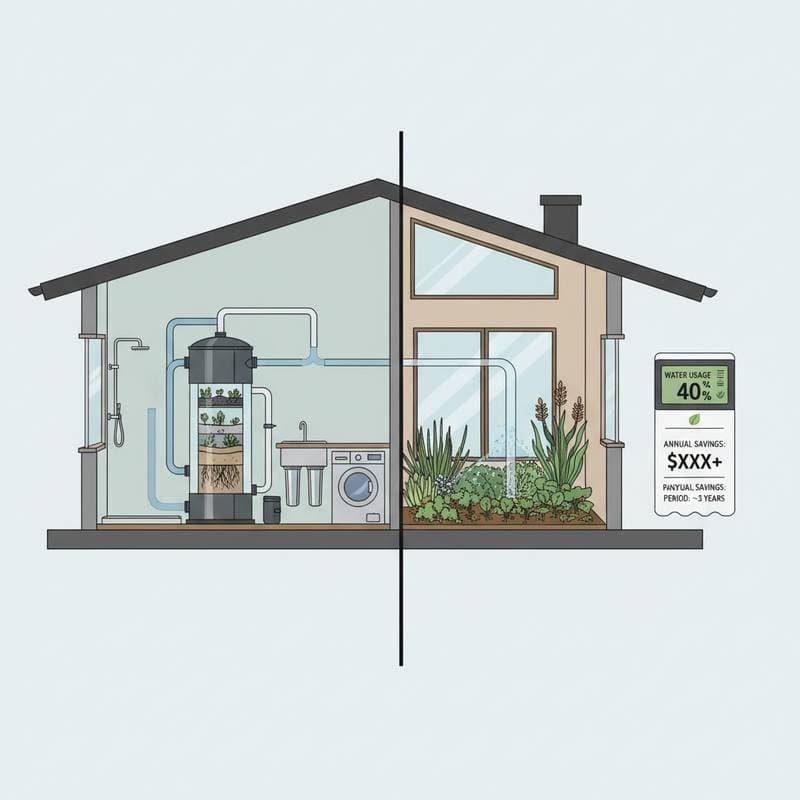

These protections complement rather than duplicate each other. Insurance manages large-scale losses, while warranties target routine malfunctions, together forming a robust defense for modern households.

Detailed Coverage Breakdown and Associated Costs

Coverage Under Home Insurance

Home insurance policies vary by provider and region, but standard components include dwelling coverage for the home's framework, personal property protection for furnishings and valuables, and additional living expenses if relocation becomes necessary. Liability limits often start at $100,000, with options to increase for greater security.

Annual premiums average between $1,200 and $2,500, influenced by factors such as home value, proximity to hazards like flood zones, and chosen deductibles ranging from $500 to $2,500. Higher premiums correlate with broader protection, including endorsements for jewelry or home-based businesses. Exclusions commonly involve floods, earthquakes, and pest infestations, necessitating separate policies for comprehensive shielding.

Coverage Under Home Warranties

Home warranties divide into basic plans covering core systems and combo plans that incorporate appliances. Standard inclusions handle issues like furnace malfunctions or water heater leaks, with optional add-ons for pools, septic systems, or well pumps. Claims trigger a service fee of $75 to $125 per incident, after which contractors address approved repairs or replacements up to policy caps, typically $1,500 to $3,000 per item.

Pricing structures annual contracts at $400 to $800, depending on coverage scope and home size. Multi-year commitments may reduce costs by 10 to 15 percent. Limitations exclude pre-existing conditions, misuse, or cosmetic defects, emphasizing the importance of initial home inspections to qualify for full benefits.

Selecting the Right Protection Based on Your Situation

Home insurance stands as non-negotiable for shielding against disasters that could devastate finances, such as a roof collapse from severe weather or theft of high-value electronics. It rebuilds or replaces without regard to age, provided the damage qualifies under policy terms.

A home warranty proves invaluable for properties with equipment over 10 years old, where repair frequencies rise. For instance, replacing an air conditioning unit might cost $3,000 to $7,000 out-of-pocket without coverage, but a warranty caps exposure at the service fee plus any excess beyond limits.

Opting for both creates layered security. Insurance handles the home's exterior and legal exposures, while warranties maintain interior functionality, reducing overall stress for busy families or investment property owners.

Essential Considerations Before Purchasing

Evaluate exclusions to avoid gaps: Home insurance riders can add flood protection for $500 to $1,000 annually in vulnerable areas, whereas warranties demand proof of proper upkeep, like annual HVAC servicing records.

Assess equipment age through professional audits; systems installed before 2015 often warrant immediate warranty enrollment to preempt failures.

Consider tolerance for outlays: If repair budgets strain monthly cash flow, warranties provide fixed costs, contrasting insurance deductibles that apply only to major claims.

Confirm lender stipulations, as most demand minimum insurance levels with proof of ongoing renewal.

Explore bundling: Providers like those offering integrated plans may discount combined policies by 5 to 20 percent, streamlining administration.

Steps to Choose and Implement Effective Coverage

-

Conduct a Home Assessment. Inspect systems and appliances for wear; newer constructions under five years may rely solely on insurance, while vintage homes benefit from warranty additions.

-

Analyze Financial Parameters. Calculate potential expenses: A single plumbing emergency could exceed $1,000, justifying warranty investment if premiums fit within 1 to 2 percent of home value.

-

Research Providers Thoroughly. Prioritize companies with A-rated financial stability, 24/7 claim hotlines, and networks of licensed technicians in your locale.

-

Examine Reviews and Fine Print. Seek feedback on payout reliability and denial rates; ensure caps align with replacement values for key items like washers or electrical panels.

-

Secure Quotes and Activate Promptly. Obtain at least three comparisons, then activate coverage before seasonal risks peak, such as winter for heating systems.

Building a Secure Home Foundation for the Future

Integrating home insurance and warranties tailors protection to specific vulnerabilities, fostering resilience against 2025's evolving challenges like climate variability and aging infrastructure. This strategic approach not only preserves asset value but also enhances daily living quality. Homeowners who align coverage with actual needs experience fewer disruptions and sustained equity growth.